Choosing the proper business bank account is one of the most crucial financial moves that any business owner or an entrepreneur can make. Opening a business bank account, no matter the size of the company you are starting or running, will be the keystone to handling the money in your business. It is necessary not just to guarantee the good functioning on an everyday level, but also to promise the financial safety, complicate the tax reporting, and foster the future development.

This blog will discuss the key points that should be thought of when deciding whether to open a business bank account and the best way to go about it with regard to meeting specific business requirements.

Why Choosing the Right Business Bank Account Matters?

It is not only a legal requirement to open a business bank account, especially at those companies that require a distinction between personal and business funds. Separate business account assists with financial sorting, creation of business picture, and streamlining your business processes. Furthermore, a nice, selected business account may also offer you multiple options that will streamline your financial tasks, including smooth transactions, fast access to credit, and financial tools that will help you watch over additional to-be-spent money and maintain the cash flow through balance checking.

It is also a mean of gaining credibility among customers/clients and suppliers, given that one has a business account. Paying or accept payments in the name of your business depicts professionalism and this feature could enhance your relations with other businesses. Second, a business account will keep you on the right side of the tax laws since the transactions are easily traced hence preparing the taxes would be so much easier.

The wrong account may imply unnecessary charges or limited access to certain features or even bad service which in turn can damage your capability to operate your business efficiently. It is, therefore, essential that one considers alternatives carefully to get the account that best suits your business format as well as needs.

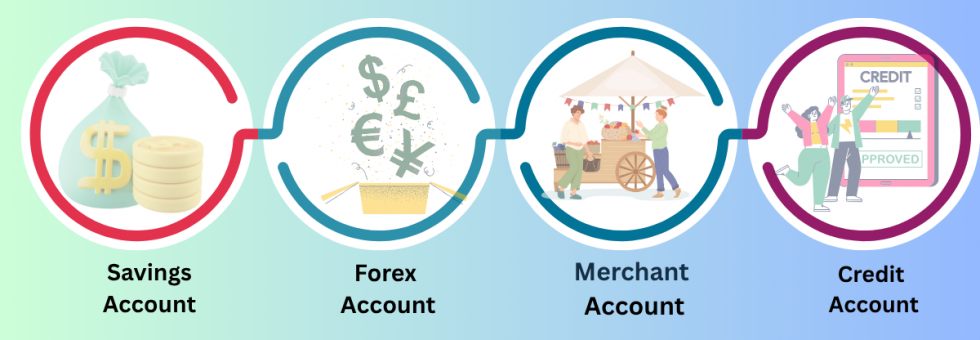

Types of Business Bank Accounts.

Choosing the right type of business bank account to use, it is necessary to be aware of the different categories of these accounts, as each one of them is specific to a type of business. Most prevalent types of accounts are given below:

1.Business Checking Account: This is a simplest and fundamental type of account in a business. It enables you to receive money and money out, get payments, and follow the everyday costs. Business checking account is account that must be opened by a business in their frequent type of transactions like paying of bills, running of payroll as well as in overall operations of the business.

Reasons why you may need it: A business checking account is probably the main choice you should make as a small firm or an individual having a single ownership. It gives you the liberty to do your everyday business such as making payments and receiving payments yet maintaining the separation between your personal and business finances.

2.Business Savings Account: A business savings account is also excellent as a means of putting in place some money to be used later. It normally gives a higher interest rate as compared to a checking account, but the rate is subject to variation. This statement is applicable to create an emergency fund of your business or save on large future costs like expansion, buying of equipment or tax.

Reasons why you may need it: A savings account is a good supplement to your financial arrangement in case you are interested in saving some money to be able to use it in the future business. Other banks have an automatic transfer between checking and savings options which will enable you to continuously increase the level of your saving.

3.Merchant Services Account: A merchant services account will be required in your business establishment when it takes credit/debit card payments. The account will enable you to do card swipes and draw the money into your business checking account.

Reasons why you may need it: A merchant services account will be necessary to businesses that conduct card payments, both physical and virtual. This is necessary particularly when you have an e-commerce business whereby you can safely receive payments sent by the customers all over the world.

4.Business Credit Account: Business credit account, otherwise referred to as business credit line or business credit card enables you to take loans and pay them off along with interest over a period. This kind of account may be useful when in need of controlling the flow of cash, when necessitating emergency purchase, or financing the expansion.

The reasons you may need it: You may want to have some more standing up and needing to afford short time expenses on your receivables, a business credit account would come in handy. It is also useful in developing your business credit which you will be useful if you require loans in future.

Factors to Consider When Choosing a Business Bank Account.

There are several factors that businesses should consider before choosing the right bank account. The right fit will vary depending on the nature of your business, your current needs, and your future goals.

1.Business Size and Structure

Bank accounts are one of the key decisions that depend on the size of your business and the structure. A small business as owned by a sole owner may just require a simple business checking account, but a bigger business or corporation may require advanced banking products. As an example, corporations may require special accounts with increased transaction limits that facilitate options such as multiple signatories. Considerations:

Sole Proprietorship: A one-person business should be able to get by with a business checking account containing no monthly charges and minimum transaction requirement.

Small or Medium Sized Business: Such businesses might require an account that has combined payroll, merchant service and access to lines of credits.

Large Corporation: A corporate bank account would have increased fee but wide-ranging services such as multiuser access, increased limits and international services.

2.Fees and Charges

One of the most significant considerations when it comes to selecting a bank account is the size of your organization as well as its structure. A sole proprietor may have fewer needs to go with a basic business checking account, but a larger company or corporation may need more of them, and fees are generally attached to them and they can differ a great deal according to the kind of account and the bank, as also with your usages. Popular charges are monthly charges, transaction charges, ATM withdrawal and outgoing wire transfer charges. Due to competition among banks; some banks can even waive their charges on maintaining a simple balance or any number of transactions per month.

Considerations: You can compare the charges of various banks and know what you are able to pay depending on the magnitude of your business. You must also ensure that the bank has no extra charges even on the number of paper statements, wire transfer or account maintenance.

3.Convenience and Accessibility

The ease of the business bank account matters a lot and this is particularly important when you are dealing with fast growing environment. Most banks have online and cell telephone banking capabilities that enable you to check accounts, transfer money between accounts, pay bills and deposit checks. The easier you will have your account accessed the easier it becomes to manage your cash flow and keep the operations moving as it should be.

Considerations:

Online and mobile banking: When selecting a bank, select one with a reasonable online and mobile platform so you can easily manage the account at a moment.

Branch Access: In case your company involves a lot of face-to-face banking, you should consider a bank nearby. Alternatively, an online bank can also work in a situation where you just need to meet the face-to-face interaction occasionally.

4.Customer Support and Reputation

Another critical aspect is the kind of customer service that is provided by your bank. Your bank must offer a good level of customer service because when you are in trouble and you need to resolve a problem or have an urgent banking need, it can all make a difference. In addition, one should make sure to enquire on the reputation of the bank regarding trustworthiness, customer satisfaction and reliability.

Considerations:

Customer Service Availability: Does the bank have a 24/7 service? Do you have business banking representatives that know what you need?

Reputation: Find out the reviews and ratings of the bank services over the internet to make sure that the other businesses have had positive experience with the bank.

5.Integration with Other Business Tools

In case your company implemented accounting software, invoicing services, or payroll, and you cannot imagine your business without it, you must make sure that your business bank account is integrated with it. Numerous new checking accounts can connect to these common bookkeeping software systems, so it is less difficult to follow costs, assess the courses of bank cash flow, and reconcile bank exchanges with yours.

Considerations:

Find out whether the bank is compatible with your accounting, payroll, and invoice programs.

Features that automatically complete transactions and do not require manual intervention should also be sought, e.g., categorizing expenses or bank feed reconciliation.

How to Open a Business Bank Account.

After choosing the most appropriate form of account, it is time that you open it. The process is simple although what may be required of you may differ according to the type of business you have and the bank you select.

Documents Required:

To open a business bank account, you’ll typically need to provide:

- Employer Identification Number (EIN) or Tax Identification Number (TIN)

- Proof of Business: This could include articles of incorporation, a partnership agreement, or your business license.

- Owner Identification: Government-issued ID (passport, driver’s license).

- Proof of Address: A utility bill, lease agreement, or other documents showing your business address.

Making the Right Choice for Your Business.

Selecting an appropriate business bank account is not merely a formality, in the real sense, it is a strategic choice that will directly determine your financial control, operational effectiveness and profitability in the long run. However, in the modern world of a rapidly changing business environment, even a minor business inefficiency: movement costs, inability to integrate, or atrocious FX rates may slowly consume your margins and restrain progress.

Each business is individual. A freelancer that works with overseas clients requires very different banking functions compared to that of a retail business that deals with high amount of cash. That is why it is so necessary to choose your playing-partner bank so that it is likely to fit not only your present size and structure, but your future ambitions. Low transaction fees, effortless online banking, real-time FX conversion, accounting integrations, such as Xero or QuickBooks, not to mention multiple currencies may dominate your list of priorities, but the right banking setup can become a valuable partner in your expansion process.

It takes just an evaluation of your transactional patterns, a review of your statements and comparisons of providers to find out where you could be experiencing an undisclosed fee or where you could be having a financial partner that is dragging your business back into the past with archaic systems and the high cost of transactions. Business owners who take the time to understand and optimize their banking setup often find it easier to manage cash flow, avoid financial stress, and plan for growth with confidence.

✅ Ready to Take Control of Your Business Banking?

Let KeyFX help you reduce unnecessary costs, simplify international payments, and find a banking setup that’s tailored to your business model.

📩 Contact our team today for a free assessment or visit our website to explore our services and see how we can support your financial strategy.